SiriusDecisions Summit 2015: B2B Buying Mythology Debunked

- Written by Carol Krol, Editor-in-Chief

- Published in Industry Insights

Many B2B industry executives and analysts believe that salespeople are being displaced by the ubiquity of digital. However, that myth has been exploded by the initial findings of the 2015 B-to-B Buying Study unveiled at the SiriusDecisions Summit 2015 in Nashville, Tenn.

This widespread viewpoint is partly based on SiriusDecisions’ own research that “67% of the buyer’s journey is now done digitally,” and compounded by similar sentiments from Forrester Research, Gartner and Corporate Executive Board.

However, the reality is that “B2B buyers interact with providers in a variety of ways throughout every phase of the decision-making process,” said Jennifer Ross, Senior Research Director, CMO Strategies at SiriusDecisions.

Examples include everything from touring an online demo to attending a vendor-hosted webinar or a peer networking event. In addition, Ross said human-to-human interactions are used more frequently at higher expenditure levels, but even in lower-priced offerings, there was evidence that personal interactions occur.

“Price point was one of the key indicators of buying behavior, which is reflected in the number and type of interactions,” Ross said.

Ross and her colleague, Marisa Kopec, VP and Group Director at SiriusDecisions, discussed the results of the survey during a presentation at the four-day sales and marketing conference. The survey polled 1,005 respondents, 86% of whom had purchased a B2B product or service within the past 90 days. The study was based on the human cognitive process when making a decision to purchase.

Ross and Kopec said B2B organizations are making strategic funding decisions based on broad marketplace assumptions, rather than an understanding of buyers and their behavior.

New Framework Outlines Three Buying Scenarios

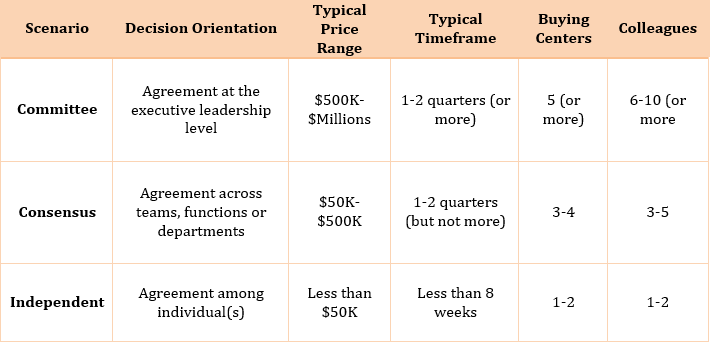

In conjunction with the survey, SiriusDecisions unveiled its B-to-B Buying Decision Process Framework. This blueprint outlines three types of buying scenarios — buying by committee, buying by consensus and independent buying — that need consideration when designing a go-to-market strategy. Each scenario has a typical price range, a typical timeframe and a range in the number of people involved.

Source: SiriusDecisions

Source: SiriusDecisions

“We believe it will change the way you develop your go-to-market strategies,” Ross told the audience. “There is not one buyer’s journey.”

A live poll during the session revealed that 37% primarily purchase by committee, while 53% of the audience indicated they largely take a consensus approach.

However, Kopec advised using the framework as a guide for creating a strategy, since interactions are episodic rather than sequential.

“Use primary and secondary research to understand the true interaction and consumption patterns of buyers, then align content and interactions to a sequential decision framework,” she said.

The SiriusDecisions Buying Interactions Model breaks down the modes of interaction into quadrants — non-human vs. human and low vs. high reciprocity. There are four types of interactions, according to Kopec:

- Facilitated interactions are those where information is delivered through online channels in a self-service manner, such as exploring syndicated content;

- Simulated interactions are similar, except buyers can choose to interact (think virtual event);

- Influenced interactions are those in which information is delivered directly from a person from the organization or a third party, such as an industry conference; and

- Orchestrated interactions are the highest level of interaction and the provider has direct control over the information exchange: information is delivered directly from a representative of the provider organization, which allows for a responsive experience adapted to the buyer such as dialogue with a sales rep, online chat or a live, vendor-hosted webinar.

Kopec said a go-to-market strategy should include a balance of non-human and human-to-human interactions. “Digital is pervasive across both of those types of interactions,” she said. “It’s time to pull the pendulum back. It’s not a digital interaction vs. a sales interaction. Digital facilitates those interactions.”

Integrated campaigns are a must, Kopec noted. The buying study revealed that on average, there are 17 buyer interactions in a committee-buying scenario. Nine of those are human. In a consensus-buying scenario, 14 interactions are typical, with eight being human. Independent buying scenarios typically see 11 interactions, six of which are human.

While buyers interact with sales representatives the most in the education phase, “buyers interact with sales reps from the beginning to the end of the buyer’s journey,” Ross explained.

The impact of those interactions, according to respondents, was overwhelmingly positive, with the majority characterizing interactions as either somewhat or very positive.

“Sales reps still matter,” Ross said.

And sales reps aren’t the only human interactions required to facilitate buying decisions; subject matter experts also influence decision-making, according to the study.

“It’s not about marketing and sales alignment,” Kopec added. “It’s about alignment across the whole organization.”

A campaign framework for marketing and sales must be based on an understanding of the interaction patterns and content preferences of the buyer audience, she said.

Kopec and Ross recommended specific next steps for B2B sales, marketing and product teams:

- Sales needs to provide the content team with the blueprint for how to deliver information to buyers through reps, and they must engineer sales enablement strategies based on interaction behaviors and the content preferences of buyer personas;

- Marketing executives should leverage frameworks as a directional guide for message, content and campaign strategy, and design content and interactions according to buying scenarios; and

- The product team needs to reduce product launch failure by understanding who buyers are and how they buy. They should also build non-human interactions that demonstrate the value of the offering based on its business value.